Backtesting

Mercury Conjunction Chiron Today 7 May 2025

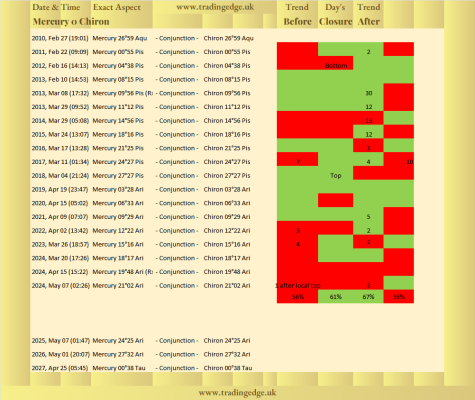

Mercury Chiron Conjunction backtesting results show 61% probability of a GREEN closure today and 67% probability of the trend after continuing to the upside for at least 2 days. 2 days was historically the minimum number of days the trend went up after that event.

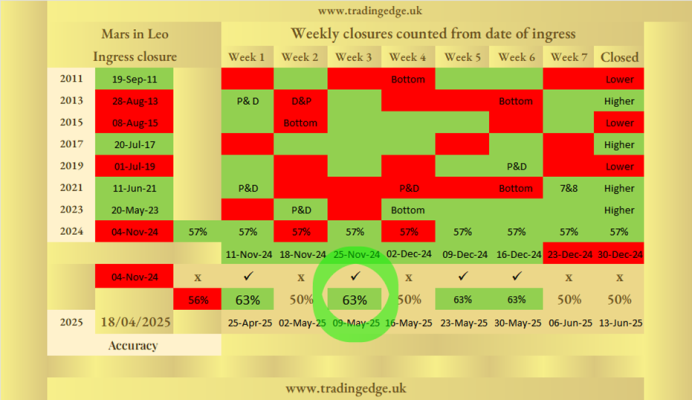

That is fighting with Venus in Aries cycle today which closes Week 1 on a RED 60% of the time. 60% red against 61% green. And the fight continues because Week 2 of Venus in Aries also closes on RED historically, but with smaller probability. And Week 2 Venus will be fighting with Mars in Leo who wants to close 9 May higher than 2 May. And 2 May is the top. So we are adding now Mercury Chiron conjunction to this equation and it is heavier on the bull side, in the short term = more continuation to the upside expected regardless of what happens today.

Today 7 May, I’m writing this at 17:22 UTC. All day the market is trading the daily VWAP while they are waiting for the FOMC announcement.

Venus in Aries Week 1 today 7 May needs to close lower than 30 April to fulfil the Venus in Aries cycle Week 1 historical probability of 60% closing on a RED. 30 April closed $94207. Unlikely tonight to dump lower than that. Dumping is expected after the FOMC and that coincides with bear aspects in the evening, however we had bear aspects yesterday afternoon on 6 May and they didn’t play any impact. So if Bitcoin does close on a RED tonight, as I forecasted on X, it is less likely to close lower than 30 April.

Mercury Chiron conjunction and Mars in Leo are the most influential cycles right now. The next bit of more solid knowledge we have is 9 May should be closing higher than 2 May according to Mars in Leo cycle with 63% historical probability.

Those who have the daily TFs forecast can see that all the cycles are stating different things, so it is very difficult to navigate with that contradictory information.

You can see what fractals have remained. I removed the invalidated ones from the visible screen. I’ll keep removing the invalidated fractals until the clear picture emerges.